The development of next-generation terminals, equipped with cutting-edge technology and designed for sustainability, is reshaping the future of global trade and logistics. Securing funding for such advanced facilities, however, poses a major challenge since they demand heavy investment to address the increasing need for efficiency, scalability, and environmental stewardship. Innovative financial instruments such as Public Private Partnerships (PPP), green bonds, and ESG finance are becoming instrumental in reducing the gap between intent and action. These types of financing models not only ensure the delivery of world-class infrastructure but also support global sustainability goals and foster economic prosperity while advancing environmental projects.

Investment Trends in Aviation and Cargo Infrastructure

The aviation and cargo industries have entered a revolution phase spurred by the needs of international trade, new technology, and the growing need for sustainable solutions. The advent of financing next-gen terminals is central to this change and involves high levels of financial investment to address burgeoning needs. Such investments encompass not only capacity increases but also sustainability and innovation in infrastructure development.

- A Shift Towards Technology-Driven Infrastructure

One profound trend in the investment landscape has been towards technological infrastructure. No longer are modern aviation and cargo terminals regarded simply as functional buildings – the new terminal is a complex ecosystem driven by automation, digitalization and data analytics. Investment in technology will improve operating efficiency, focus on more efficient use of resources, and create an improved user experience.

For example, cargo handling systems are increasingly turning to automation. Automated guided vehicles (AGVs) and robotic sorting systems will eliminate human error and, most importantly, facilitate 24/7 operations capabilities so that the flow of goods is exerted even during peak movement times. Furthermore, the emergence of IoT (internet of things) enabled monitoring systems will allow various stakeholders to track shipments in real-time – including the monitoring and reporting system will bring meaningful transparency and accountability to the supply chain.

- Regional and Sectoral Focus

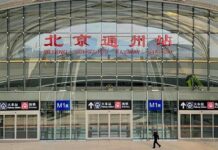

Investment in aviation and cargo infrastructure is becoming more regionalized and sectoral to address the needs of each sector and region. Industrialized economies of North America and Europe are focused on renewal of older infrastructure to accommodate new technologies and sustainability. Emerging economies in Asia, the Middle East, and Africa are investing heavily in new airports and new cargo facilities to accommodate the increase in industrialization, urbanization, and trade flows.

Sector-specific investments also influence infrastructure trends. The rise of e-commerce, for instance, has created a boom in demand for specialized facilities such as fulfillment centers, cold storage, and last-mile delivery terminals. Terminal investments are now oriented toward meeting these needs, so that infrastructure keeps pace with evolving global trade dynamics.

- Sustainability as a Core Investment Driver

Sustainability has come to the forefront of investment in aviation and cargo infrastructure. Every new terminal project is designed to minimize its environmental impact with energy/computerized conservation, renewable energy connections, and green building methods. Investors are paying more attention to facilities applying environmental, society and governance (ESG) principles since they align with global efforts to mitigate climate change and sustainable development.

For instance, terminals driven by sustainable energy systems, like solar panels and wind turbines, are increasingly being used. Investments in efficient systems, like LEDs and high-end HVAC systems, also minimize carbon footprints. Moreover, some terminals are introducing circular economy philosophies, like recycling construction waste and utilizing green materials, to further boost their environmental reputation.

- Financing Models Supporting Investment Trends

Creative financing models are being developed to finance the large capital needs for future terminals. For instance, public-private partnerships (PPPs) are playing an increasingly important role, especially in regions where government funds are insufficient to meet infrastructure demand. Through the mixing of public sector financing with private sector expertise and capital, PPPs ensure that terminal projects have sufficient funding and effective management.

Green bonds are also another funding mechanism that is gaining acceptance. Green bonds are tailored to support environmentally friendly projects and thus are well-suited for terminal developments that focus on green technologies and processes. Also under consideration are hybrid financing models that combine conventional loans with novel instruments such as revenue-sharing arrangements and equity participation.

- Partnerships and Long-Term Returns

Investors are increasingly appreciating the merits of partnerships in ensuring long-term success in terminal schemes. Partnerships between developers, operators, technology providers, and financiers are ensuring that projects are comprehensively planned and executed. By aligning objectives and aggregating expertise, these partnerships develop terminal facilities that are both economically viable and operationally effective.

In addition, the long-term duration of infrastructure investments guarantees stable returns, and terminals are a very desirable asset class for sovereign wealth funds as well as institutional investors. With world trade on the rise, the need for streamlined and environmentally friendly terminals will also increase, cementing their role as key drivers of economic growth.

Public-Private Partnership Models Across Asia

Public-Private Partnerships (PPPs) are a pillar of infrastructure funding, especially in Asia. They have evolved into the preferred model of financing for governments intending to fund large terminal projects by leveraging private sector expertise and resources while retaining regulatory authority. PPPs are transforming funding mechanisms and allowing for terminal growth to be undertaken sustainably.

- The Popularity of PPPs in Asia

Asia’s economic booms and its growing global trade importance create a need for infrastructure that can sustain major operations. The public budget alone tends to fall short of meeting the magnitude of infrastructural demand. PPP models fill this gap by combining resources from the public and private sectors alike, not only funding projects with what they need but also managing them cost-effectively.

In several Asian nations, PPP projects have worked well to build aviation and cargo hubs. As an example, governments contribute land and regulatory assistance, but private parties introduce technical skills, operating expertise, and funding. The outcome is a model of joint risk and reward for all the participants.

- Varied PPP Models for Terminal Development

PPPs in terminal financing usually take varied forms depending on the needs of the project and the roles played by the partner. Build-Operate-Transfer (BOT) arrangements are the dominant model in terminal projects, where private parties will build and operate the terminal for an established period before turning back to public ownership.

Joint Venture (JV) arrangements are also common, wherein governments partner with private investors in co-ownership / co-operating a terminal facility. The JV approach ensures an alignment of interest in that both public and private parties have a financial stake and interest in the success of the project. Hybrid projects are increasingly common, whereby a PPP arrangement is used in combination with other forms of funding arrangements that provides flexibility and allows for risk reduction..

Table 1: Common PPP Models in Terminal Financing

| Model | Characteristics |

| Build-Operate-Transfer (BOT) | A private firm builds and operates before handing over |

| Joint Ventures (JV) | Government and private firms jointly own/manage projects |

| Hybrid Models | Combine PPPs with other financing mechanisms |

ESG Financing for Sustainable Terminal Development

Sustainability became a clear focus area as terminal development evolved with social, environmental and governance (ESG) factors utilizing meaningful investment decisions. ESG financing provides funding to fund climate-friendly infrastructure but resonates with the changing aspirational view of the world involving climate change and social equity.

- Green Bonds for Eco-Friendly Terminals

Green bonds have emerged as a crucial fundraising mechanism for funding sustainable projects. Green bonds are used to finance projects that cut carbon emissions and environmental costs. In the case of terminal developments, green bonds are utilized to finance energy-saving designs, renewable energy facilities, and waste recycling systems.

For instance, a terminal that is financed through green bonds can have solar panels, rainwater harvesting facilities, and LED lighting to reduce its carbon footprint. Such projects attract investors due to the fact that they complement the increasing need for sustainability investment coupled with their competitive returns.

- Social Responsibility in Terminal Development

In addition to environmental issues, ESG financing also focuses on the social components of terminal development. Contemporary terminals are conceived to uphold inclusiveness to the extent that they accommodate the needs of passengers with varying needs, including accessible facilities for people with disabilities. Promoting just labor practices and equitable working conditions throughout terminal construction and operations is also an essential consideration.

Through the inclusion of governance principles, ESG financing also promotes transparency, accountability, and ethical decision-making. This helps ensure that terminal projects are constructed in a way that is beneficial to all stakeholders, such as employees, passengers, and local communities..

Table 2: Key Features of ESG-Funded Terminals

| Focus Area | Key Attributes |

| Environmental Sustainability | Energy-efficient systems, renewable energy integration |

| Social Responsibility | Accessibility, equitable labor practices |

| Governance Standards | Transparency, ethical management |

Conclusion

Financing next-gen terminals presents both an opportunity and a challenge in this new world of infrastructure. With investing behaviors valuing innovation and scalability, the aviation and cargo industries are on the cusp of major breakthroughs. Public-Private Partnerships in Asia demonstrate the efficiency of collaborative development models, while ESG financing emphasizes the necessity of sustainability for contemporary terminal projects.

As the need for sophisticated, efficient, and environmentally friendly infrastructure keeps mounting, creative financing structures like green bonds and hybrid PPP models will assume a leadership position in sparking development. Where public policies, private investment, and sustainability-driven initiatives converge, it is a given that the terminals of the future will not only respond to the needs of growth in trade around the world but also towards a greener and more balanced future.