The aviation sector stands at a transformative crossroads where environmental responsibility intersects with technological innovation. As the industry contributes approximately 2.5% to global greenhouse gas emissions and faces mounting pressure to decarbonize, Sustainable Aviation Fuel has emerged as the most viable pathway toward achieving net-zero carbon emissions by 2050. Unlike emerging technologies such as hydrogen propulsion or electric aircraft that require fundamental redesign of infrastructure and fleets, Sustainable Aviation Fuel offers an immediate, drop-in solution compatible with existing aircraft and fuel distribution systems. This compatibility, combined with the potential to reduce lifecycle carbon emissions by up to 90% compared to conventional jet fuel, positions SAF as the cornerstone of aviation’s climate strategy for the coming decades.

The journey toward mainstream adoption of Sustainable Aviation Fuel represents a complex interplay of breakthrough technologies, evolving regulatory frameworks, economic considerations, and ambitious global commitments. From commercial production facilities in California to demonstration plants across Europe and Asia, the SAF ecosystem is expanding at an unprecedented pace, driven by collective determination from airlines, fuel producers, governments, and environmental stakeholders to fundamentally transform how the world flies.

Global Adoption Patterns of Sustainable Aviation Fuel

The landscape of Sustainable Aviation Fuel adoption reveals significant regional disparities shaped by policy frameworks, feedstock availability, and industrial capacity. Europe has positioned itself as the global leader through aggressive regulatory mandates, most notably the ReFuelEU Aviation regulation that came into force in January 2025. This landmark legislation requires aviation fuel suppliers to ensure that at least 2% of fuel supplied at European Union airports consists of SAF, with progressive increases to 6% by 2030 and an ambitious 70% by 2050. The regulation’s comprehensive approach addresses not only fuel suppliers but also establishes requirements for airports and aircraft operators, creating a coordinated ecosystem that prevents fuel tankering and ensures compliance across the value chain.

North America follows a different but equally significant trajectory, leveraging market-based incentives rather than strict mandates. The United States Inflation Reduction Act has catalyzed substantial investment through the 45Z Clean Fuel Production Credit, offering SAF producers up to $1.75 per gallon in tax credits based on carbon intensity reductions. This financial support mechanism, combined with the Sustainable Aviation Fuel Grand Challenge announced in 2021, targets domestic consumption of 3 billion gallons by 2030 and 35 billion gallons by 2050. Major American airlines have signed long-term offtake agreements with SAF producers, demonstrating commercial commitment that extends beyond regulatory compliance.

Global SAF blending mandates and targets across key regions demonstrate Europe’s early leadership with a 2% mandate in 2025, while Japan and Brazil have set ambitious 10% targets for 2030

The Asia-Pacific region represents an emerging frontier for Sustainable Aviation Fuel, with 2025 marking a pivotal transition from aspiration to action. Singapore has established itself as the regional pioneer with a confirmed near-term goal of 1% SAF by 2026, potentially rising to 3-5% by 2030. India’s government has set blending targets of 1% by 2027, 2% by 2028, and 5% by 2030 for international flights, recognizing the country’s significant potential for SAF production given its agricultural powerhouse status with over 750 million tonnes of biomass annually. China has achieved initial SAF production outputs with a government target of 50,000 tonnes by 2025, while Japan pursues an ambitious 10% mandate by 2030 supported by government subsidies. This regional diversity in policy approaches reflects varying stages of industrial maturity, feedstock availability, and aviation market dynamics across the Asia-Pacific landscape.

Breakthrough Technologies Shaping SAF Production

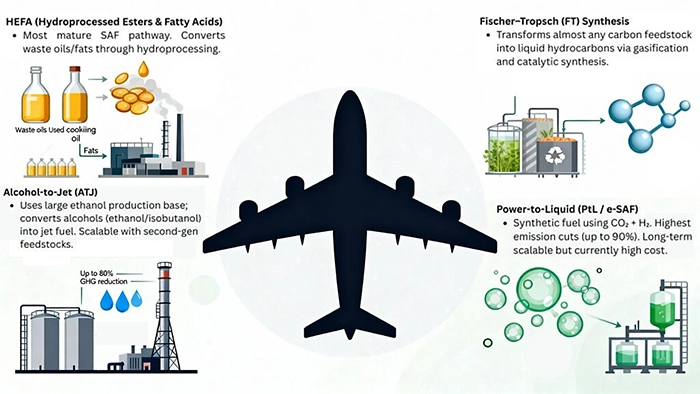

The technological foundation of Sustainable Aviation Fuel production rests on multiple certified pathways, each offering distinct advantages in terms of feedstock flexibility, scalability potential, and carbon intensity. Currently, eight different technology platforms have received ASTM certification for commercial aviation use, with continuous advancement expanding the possibilities for sustainable fuel production.

Hydroprocessed Esters and Fatty Acids represents the most mature and widely deployed SAF production pathway, accounting for the majority of current commercial output. The HEFA process converts triglyceride-based feedstocks such as used cooking oil, waste animal fats, and plant oils through hydroprocessing to break apart long chains of fatty acids, followed by hydroisomerization and hydrocracking. However, HEFA faces inherent scalability constraints due to limited availability of waste oils and fats, creating a ceiling on how much this pathway alone can contribute to meeting future SAF demand. Recent price spikes in vegetable oil feedstocks in 2022 highlighted the vulnerability of relying too heavily on oil-based sources, spurring industry interest in diversifying production technologies.

Fischer-Tropsch synthesis offers transformative potential by enabling conversion of virtually any carbon-containing material into Sustainable Aviation Fuel. The FT process begins with gasification of feedstock, including municipal solid waste, agricultural and forest wastes, or energy crops to produce synthesis gas, which then undergoes catalytic conversion into liquid hydrocarbons.

The Alcohol-to-Jet pathway represents a particularly promising avenue for scaling Sustainable Aviation Fuel production due to the massive existing ethanol industry infrastructure. ATJ technology converts alcohols, primarily ethanol and isobutanol into jet fuel through dehydration, oligomerization, and hydrogenation processes. The strategic advantage of ATJ lies in feedstock abundance: ethanol yield per acre is six times higher than oils used in HEFA processes, and United States ethanol production operates at significantly larger volumes. The technology’s flexibility extends beyond conventional corn-based ethanol to include second-generation feedstocks such as agricultural residues and sugar bagasse, eliminating competition with food crops while expanding potential supply.

Power-to-Liquid technology represents the frontier of Sustainable Aviation Fuel production, offering theoretically unlimited scalability unconstrained by biomass availability. PtL, also known as e-SAF or synthetic fuel, combines captured carbon dioxide with green hydrogen produced from renewable electricity through Fischer-Tropsch synthesis to create liquid hydrocarbons. The transformative potential of this pathway lies in its emission reduction capability, up to 90% lifecycle greenhouse gas reductions compared to conventional jet fuel, and its ability to utilize abundant renewable energy resources While PtL currently faces cost challenges, remaining 2-3 times more expensive than conventional jet fuel due to high costs of renewable hydrogen and CO₂ feedstock, the pathway’s scalability advantages position it as essential for meeting long-term aviation decarbonization targets.

Power-to-Liquid technology offers the highest lifecycle emission reduction potential at 90%, while established pathways like HEFA and Fischer-Tropsch deliver up to 80% reductions compared to conventional jet fuel

Environmental and Economic Impact of SAF Integration

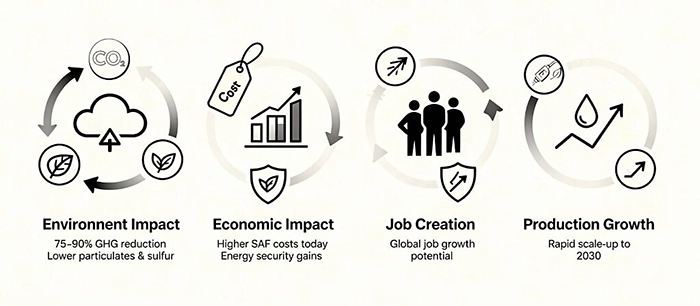

The environmental benefits of Sustainable Aviation Fuel extend far beyond carbon dioxide reductions to encompass broader air quality improvements and ecosystem protection. Lifecycle analysis demonstrates that SAF can reduce greenhouse gas emissions by 75-90% compared to conventional jet fuel, depending on feedstock source and production pathway. This dramatic reduction stems from SAF’s closed-loop carbon cycle: the CO₂ released during combustion is offset by the carbon absorbed during the growth of biomass feedstocks, effectively recycling atmospheric carbon rather than introducing new fossil carbon. Beyond greenhouse gases, SAF delivers significant improvements in local air quality by reducing particulate emissions by up to 90% and virtually eliminating sulfur emissions, benefiting communities surrounding airports and along flight corridors. These non-CO₂ environmental benefits represent critical public health improvements that extend the value proposition of Sustainable Aviation Fuel beyond climate mitigation alone.

The economic landscape surrounding Sustainable Aviation Fuel integration reveals both substantial challenges and transformative opportunities for the aviation industry and broader economy. The persistent cost premium of SAF, currently 2 to 3 times more expensive than conventional jet fuel for bio-based pathways, and up to 7 times more costly for synthetic Power-to-Liquid fuels, represents the most significant barrier to widespread adoption. This price disparity stems from multiple factors including advanced refining processes, feedstock procurement costs, and the early-stage nature of production infrastructure requiring substantial capital investment. Airlines operating on traditionally thin profit margins face difficult economic decisions when incorporating higher-cost sustainable fuel into operations, creating a chicken-and-egg dynamic where producers hesitate to scale production without guaranteed demand, while airlines struggle to commit to large-scale purchases at premium prices.

However, the economic case for Sustainable Aviation Fuel transcends simple fuel cost comparisons to encompass broader value creation and risk mitigation. Domestic SAF production offers significant fuel security benefits by reducing dependence on volatile international petroleum markets and vulnerable supply chains. Economic modeling for New Zealand demonstrates that domestic production of 30% of jet fuel needs as SAF by 2050 could generate over $1.3 billion in Gross Value Added and create 5,700 jobs while enhancing energy independence. The global transition to SAF could create up to 14 million jobs, particularly benefiting developing nations with land suitable for sustainable feedstock cultivation but unviable for food crops. For tourism-dependent economies, SAF adoption represents insurance against revenue losses from environmentally conscious travelers choosing alternative transportation or destinations based on sustainability credentials.

Global SAF production is experiencing exponential growth, from 15.84 million gallons in 2022 to a projected 3 billion gallons by 2030, representing a dramatic scaling required to meet aviation industry decarbonization goals

Government Policies and Incentives Driving SAF Growth

Government intervention through regulatory mandates, financial incentives, and research support has proven essential for catalyzing Sustainable Aviation Fuel market development. The European Union’s comprehensive approach through ReFuelEU Aviation establishes clear, escalating supply obligations that create market certainty for producers and investors. The regulation’s design addresses multiple market participants simultaneously: fuel suppliers must blend increasing percentages of SAF, airports must enable refueling infrastructure, and aircraft operators must uplift sufficient fuel to prevent tankering practices that could undermine environmental objectives. Penalties for non-compliance are substantial, calculated at least twice the yearly average price of conventional jet fuel multiplied by the quantity of SAF not uplifted, creating powerful economic incentives for adherence.

The United States has pursued a complementary strategy emphasizing financial incentives and technological development support. The Inflation Reduction Act’s 45Z Clean Fuel Production Credit provides up to $1.75 per gallon for SAF production, with the credit multiplied by an emissions factor that rewards lower-carbon-intensity fuels. This market-based mechanism allows producers flexibility in pathway selection while incentivizing continuous improvement in carbon performance. The Department of Energy’s Bioenergy Technologies Office has deployed substantial funding for SAF projects, including $244.5 million specifically allocated for sustainable aviation fuel development and $46.5 million for low-emission aviation technology.

Asia-Pacific nations are rapidly developing policy frameworks tailored to regional circumstances and industrial capabilities. Australia’s September 2025 announcement of a A$1.1 billion Cleaner Fuels programme represents the first major government subsidy specifically targeting SAF in the region, with a ten-year funding commitment aimed at having production facilities operational by 2029. India’s forthcoming SAF policy, expected to be released soon according to November 2025 government statements, will address critical classification issues, reclassifying SAF from fossil fuels to bioenergy would unlock access to existing incentive schemes such as the Gobardhan programme for biomass utilization. Singapore’s passenger levy system to fund SAF adoption from 2026 demonstrates innovative financing mechanisms that distribute transition costs across the aviation ecosystem rather than concentrating burden on airlines alone.

Challenges

Despite remarkable progress and growing momentum, Sustainable Aviation Fuel faces formidable challenges that will determine the pace and scale of industry transformation. Feedstock availability and competition represent fundamental constraints, particularly for established pathways like HEFA that depend on limited supplies of waste oils and fats. As SAF production scales, competition for biomass resources will intensify not only within aviation but across multiple sectors pursuing decarbonization, renewable diesel, marine fuels, and industrial applications all compete for similar feedstock sources. The risk of unintended environmental consequences from feedstock sourcing, including potential land use changes that could negate carbon benefits, necessitates rigorous sustainability certification and transparent lifecycle accounting.

Infrastructure development requirements extend far beyond production facilities to encompass storage, distribution, and airport refueling capabilities. Industry estimates suggest that global aviation infrastructure upgrades for SAF compatibility could exceed $150 billion over the next decade, creating a massive coordination challenge among airports, fuel suppliers, and airlines who must synchronize investments to avoid stranded assets. The geographic concentration of current SAF production, primarily in North America and Europe, creates supply-demand mismatches in rapidly growing Asia-Pacific aviation markets, highlighting the need for decentralized production facilities closer to consumption hubs. The classic infrastructure chicken-and-egg problem, where each stakeholder hesitates to invest without confidence in others’ commitments, represents perhaps a greater barrier than production technology itself.

Conclusion

The future trajectory of Sustainable Aviation Fuel depends critically on maintaining policy support, securing adequate investment capital, and achieving global coordination on sustainability standards. Fragmented certification criteria across regions, where fuel qualifying as SAF in one jurisdiction may face stricter requirements elsewhere, creates market inefficiencies and competitive disadvantages for producers. The International Civil Aviation Organization’s Carbon Offsetting and Reduction Scheme for International Aviation provides a framework for global coordination, but effective implementation requires harmonization of lifecycle emission calculation methodologies and sustainability criteria. Industry projections suggest SAF could reach 10% of global aviation fuel by 2030 and 30% by 2040, with the International Energy Agency estimating SAF could account for 65% of aviation’s carbon reduction pathway to net-zero by 2050. Realizing these ambitious targets requires sustained commitment from all stakeholders, governments providing stable, long-term policy frameworks; airlines making binding purchase commitments; investors financing infrastructure at unprecedented scale; and technology providers continuing to innovate and reduce costs.

The transformation of global aviation through Sustainable Aviation Fuel represents one of the defining infrastructure and technological challenges of the twenty-first century. Success will require unprecedented collaboration across industries, borders, and traditional competitive boundaries, united by recognition that sustainable flight is not merely an environmental imperative but an economic and social necessity for preserving aviation’s essential role in connecting humanity.